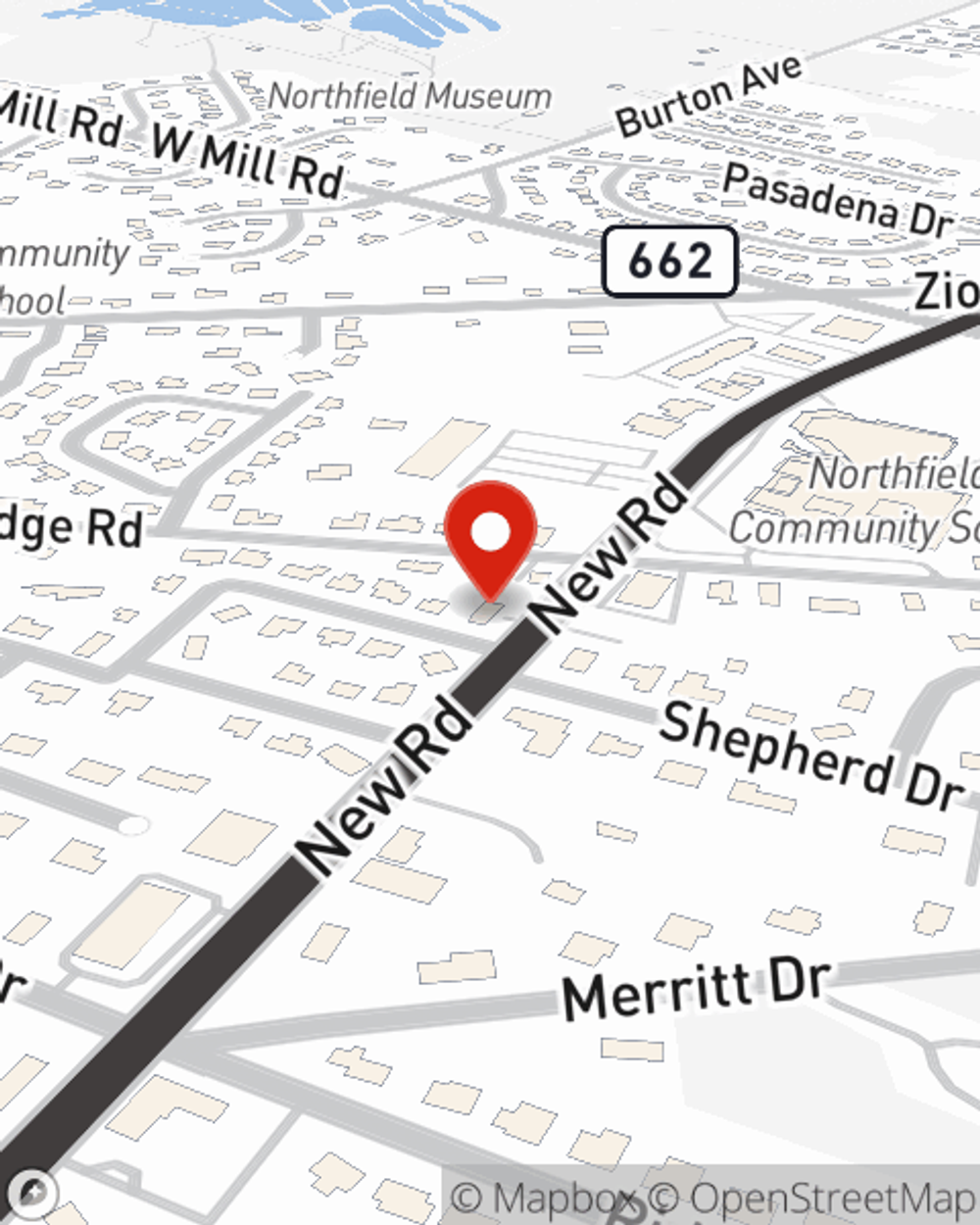

Life Insurance in and around Northfield

Get insured for what matters to you

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

- Burlington County

- Medford

- Delaware

- Pennsylvania

- Atlantic County

- Northfield

- Egg Harbor Township

- Linwood

- Atlantic City

- Somers Point

- Pleasantville

- Hammonton

- Shamong

- Tabernacle

- Central Jersey

- South Jersey

- North Jersey

- Jersey Shore

- Marlton

It's Never Too Soon For Life Insurance

The normal cost of funerals today is around $8,300, according a recent study by the National Funeral Directors Association. Unfortunately, it may be difficult for the ones you leave behind to pay for your funeral as they mourn. That's where Life insurance with State Farm comes in. Having the right coverage can help the people you love pay for burial costs and not end up with large debts.

Get insured for what matters to you

Don't delay your search for Life insurance

Agent Carinne Leisey Gulati, At Your Service

You’ll get that and more with State Farm life insurance. State Farm has excellent protection plans to keep those you love safe with a policy that’s adjusted to fit your specific needs. Luckily you won’t have to figure that out alone. With personal attention and fantastic customer service, State Farm Agent Carinne Leisey-Gulati walks you through every step to develop a policy that covers your loved ones and everything you’ve planned for them.

Interested in checking out what State Farm can do for you? Call or email agent Carinne Leisey-Gulati today to get to know your specific Life insurance options.

Have More Questions About Life Insurance?

Call Carinne at (609) 646-0600 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Three main misconceptions people have about life insurance

Three main misconceptions people have about life insurance

Three Main Misconceptions People Have About Life Insurance - State Farm®

Carinne Leisey-Gulati

State Farm® Insurance AgentSimple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Three main misconceptions people have about life insurance

Three main misconceptions people have about life insurance

Three Main Misconceptions People Have About Life Insurance - State Farm®